Markets your business can cater to today are no longer bound by geography. In this environment, merchants can enter new markets and access new customer bases.

A comprehensive understanding of the consumer of the region you are targeting, coupled with a fast, secure and efficient payment system that supports fund transfer beyond borders.

While the nuances of consumer behaviour are a tale for a different time, we are here to break down the fund transfer part of the equation – commonly known as Cross-Border Payments.

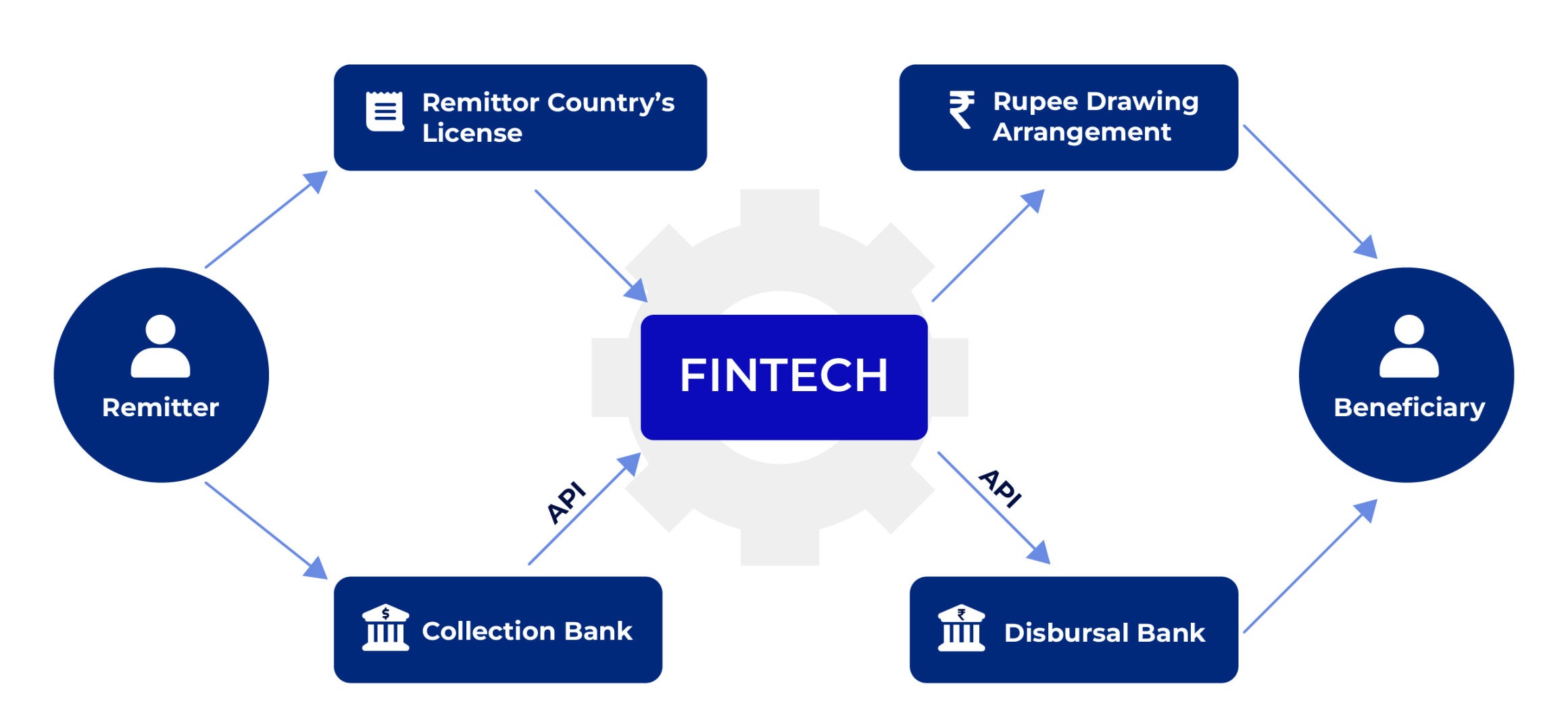

Fintechs have leveraged technology to revolutionise the Cross-Border ecosystem by introducing low-cost solutions for international payments across individuals, small businesses and corporations. Through innovative solutions focused on enhanced customer service, extensive global reach, flexible payment options, lower fees, and reduced transaction times, fintech organisations in the recent past have been facilitating transfers in a secure, fast and affordable way. There are two primary models:

A cross-border payment refers to any transaction in which the payer and the payee are located in different countries. These transactions can occur between Business-To-Business, Business-To-Peer, Peer-To-Business and Peer-To-Peer. Individuals or businesses can initiate these transactions, which often involve currency conversions and can be made using various payment methods.

The value of cross-border payments is expected to reach over $250 trillion by 2027, making it one of the fastest-growing segments within the global payments ecosystem.

Cross-border payments involve different time zones and different currencies. Multiple compliance checks add layers of friction, such as significant delays, excessive charges and uncertain receipt of payment.

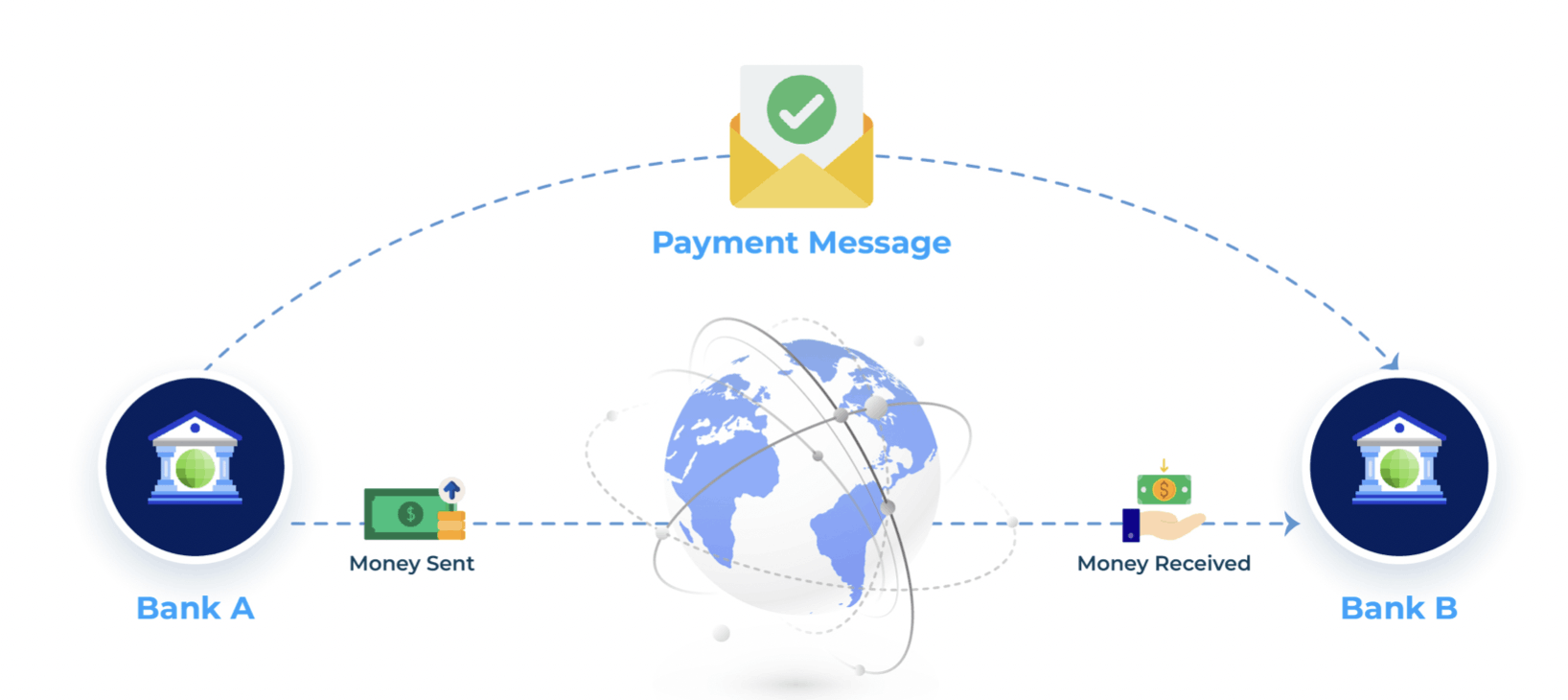

As cumbersome as it sounds, let us walk you through an example of what the cross-border payment process looks like

1. If you’re sending 10,000 INR to Singapore, for example:

2. Your domestic bank sends the instructions to a settlement bank.

3. The settlement bank executes the transaction via its relationship with a corresponding settlement bank in Singapore.

4. The international settlement bank transfers the money to the receiver’s bank, ultimately landing it in the bank account.

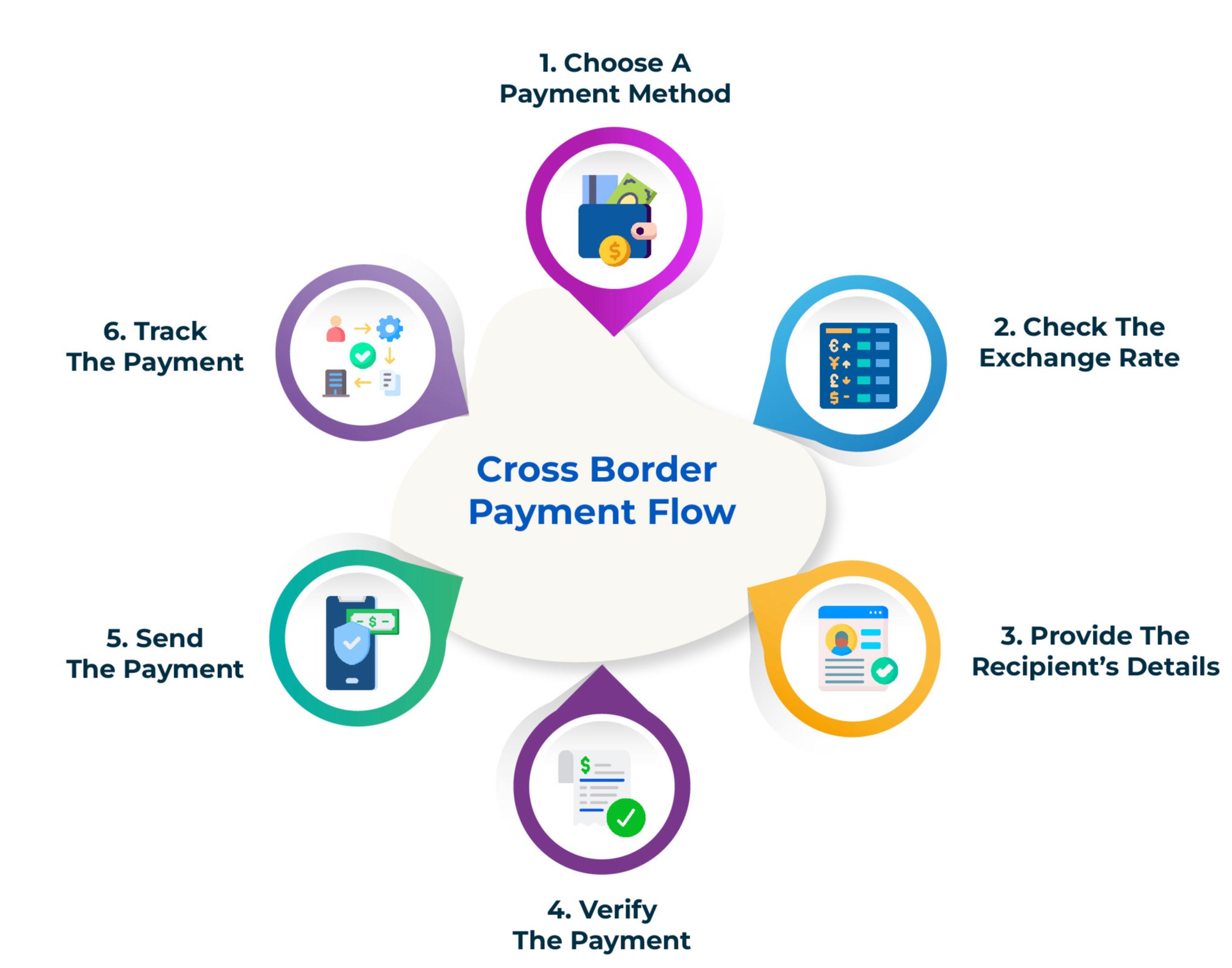

Choose from the multiple ways you can send cross-border payments, including wire transfers, credit card transactions, electronic funds transfers, international money orders, online payment platforms, and cryptocurrencies best suited to your needs.

Check the transfer cost incurred via the exchange rate prevalent during the time of the payment. Please note that exchange rates can vary depending on the country and payment method.

Fill in the basic details such as their name, address, bank account number, and routing number. You may also need to provide additional information, such as the purpose of the payment and any relevant reference numbers. Different financial institutions and transfer networks require different information to process the transfer.

Before sending a cross-border payment, you should double-check all the details to ensure they are accurate. This will help to avoid any delays or errors in the payment process – which is especially important for irreversible payment methods such as money orders.

Once you have verified the payment, you can send it using your chosen payment method. The time it takes to receive the payment can vary depending on the method used and the countries involved.

Always track your cross-border payment to ensure the recipient receives it via your payment provider’s tracking number or reference number.

International Wire Transfer

This form of cross-border payment involves the sender providing their bank with instructions to send money to a recipient in another country, and the banks involved in the transfer facilitate the movement of funds across borders. For instance, using IBAN & SWIFT codes to transfer from one bank to another in a different country.

Electronic Fund Transfers

These are electronic transactions where you can transfer funds between the bank accounts within the US. EFT payments are considered very efficient; it takes 1-2 business days for a transfer to be complete, and it also supports many types of payments, such as direct deposit, electronic bill payment, and POS transactions.

Digital Wallets

Digital wallets are also an example of a cross-border payment. Products such as PayPal, Google Pay or Apple Pay help ease cross-border transactions. However, it’s important to note that digital wallets are not suitable for large transfers but rather for individual or P2P due to the transaction fees that can vary differently.

Credit/ Debit Card Payments

Credit and debit card payments are considered two cross-border payment examples. Due to their popularity and number of usages, credit and debit cards are used almost everywhere in the world, especially for online and offline purchases. Nevertheless, one should always be wary of the fees incurred while using them.

Digital Currencies

Digital currencies have become increasingly popular due to the amount of charges and the variety of categories you can use. Some examples are Bitcoin, Litecoin, Ethereum, and many more. One study showed 75% of retailers plan to accept cryptocurrency as a payment method by 2024. These payments can be processed quickly and securely, but crypto has some drawbacks due to volatility in the cryptocurrency market.

Money Orders and Paper Checks

The classic, timeless option for cross-border payment is still used today. To use paper checks, all you need to do is write the accurate name of the receiver (payee) and their address to send them the check. The best thing about paper checks is that there are neither fees involved in a transaction nor any intermediary banks. However, the downside of paper checks is that it can take weeks from postal mail and must be cashed.

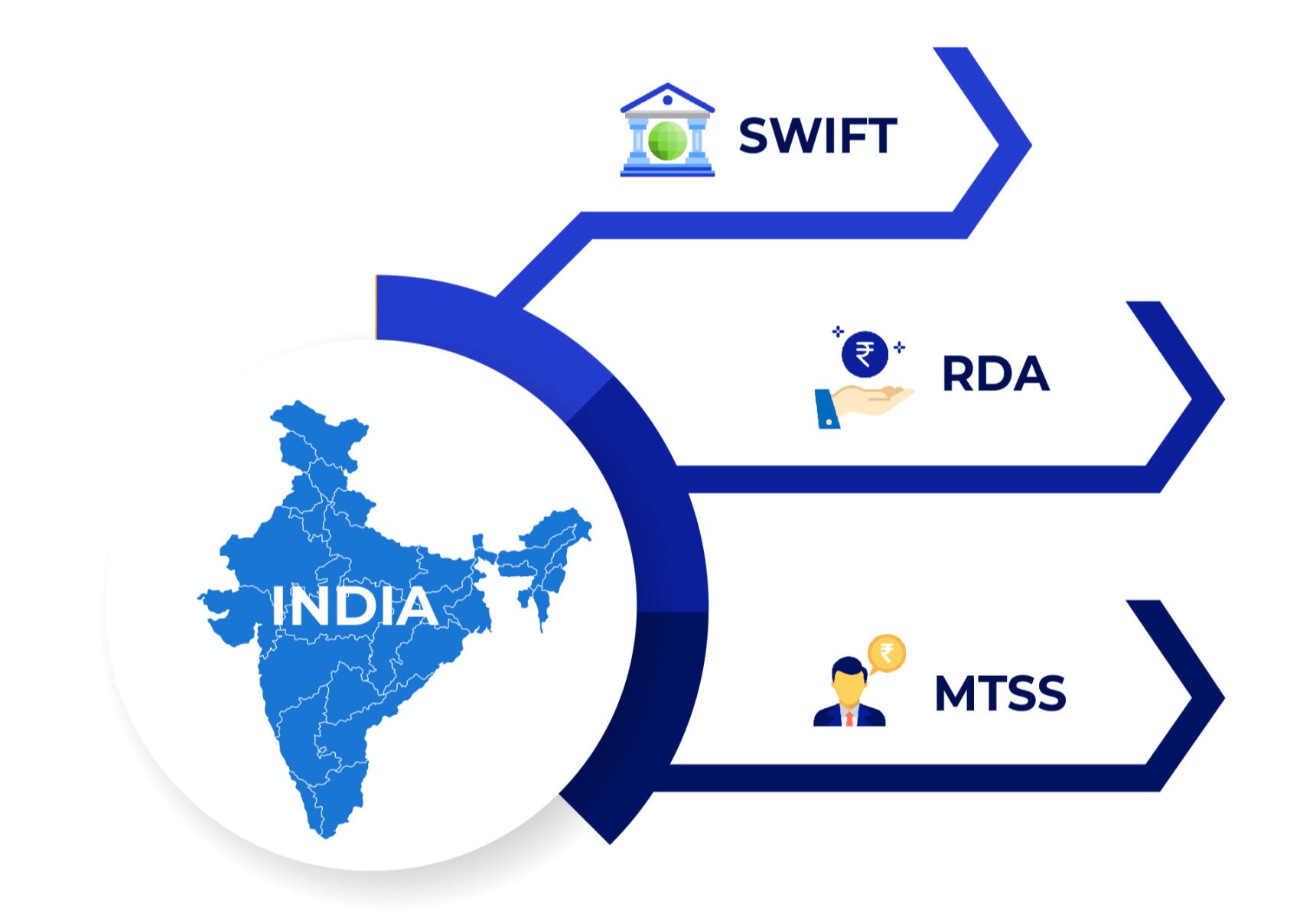

SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a global payment network founded in 1973 that facilitates international transactions through bank transfers. The network connects approximately 10,000 financial institutions from 212 countries worldwide, facilitating an average of 11,000 clients worldwide to initiate nearly 33.6 million transactions regularly.

RDA, or Rupee Drawing Arrangement, is essentially a channel through which Indians can receive remittances from selected countries worldwide. Indian banks have partnered with many international exchange houses to provide a quicker remittance facility to Indians in foreign countries.

MTSS is a strategic tie-up between overseas principals and Indian agents who disburse funds to beneficiaries in India at ongoing exchange rates. Transfers usually take one to three days, with charges ranging from 0.3–5% of the transaction amount.

Cross-border transactions usually are pricier than domestic ones due to the costs involved in transferring funds across geographies. Some of these costs may include currency exchange, regulatory, and intermediary charges – namely, the fee each participant in the transaction flow charges for their services.

International bank payments typically take up to five days to process and clear, which is a slower turnaround time than near-instant domestic payments.

Localisation is more than translating your website and communication channels. To facilitate cross-border payments, businesses must ensure compliance with the regulatory requirements in each country their business is selling to.

Fintechs have leveraged technology to revolutionise the Cross-Border ecosystem by introducing low-cost solutions for international payments across individuals, small businesses and corporations. Through innovative solutions focused on enhanced customer service, extensive global reach, flexible payment options, lower fees, and reduced transaction times, fintech organisations in the recent past have been facilitating transfers in a secure, fast and affordable way. There are two primary models:

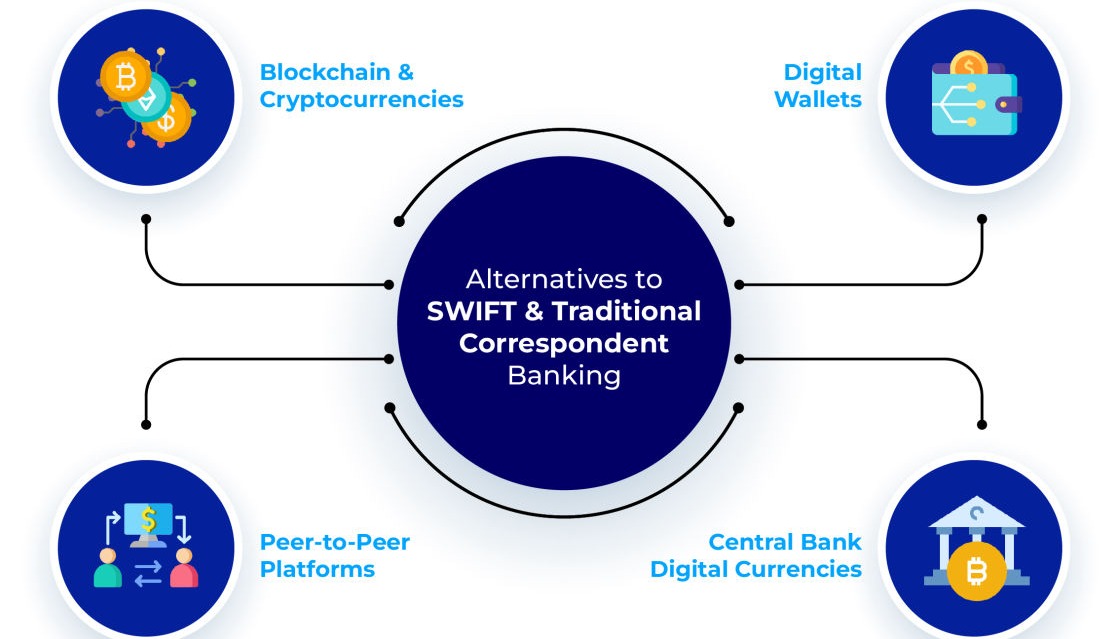

These plethoras of solutions refer to alternative systems and technologies designed to facilitate international money transfers and transactions. These systems offer alternatives to the conventional SWIFT network and traditional correspondent banking. We have the likes of

Blockchain technology and cryptocurrencies, like Bitcoin, have enabled cross-border payments without the need for traditional banks. Transactions occur directly between parties, typically with lower fees and faster settlement times.

Many fintech organizations provide digital wallets that offer cross-border payment solutions that leverage their own networks and partnerships. These services often provide competitive exchange rates and lower fees.

P2P payment platforms like PayPal and Venmo have expanded globally, allowing users to send money across borders quickly and efficiently.

Some central banks are in the nascent stage of exploring or implementing their digital currencies, which could facilitate more efficient cross-border transactions as the issuing government would directly back them.